how much does it cost to hire a tax attorney

Find Accountants you can trust and read reviews to compare. Ad You Have Rights.

Top 5 Income Tax Lawyers In India And One Landmark Case They Argued

Free Case Review Begin Online.

. Other tax attorneys charge a. Typical Cost of Hiring a Tax Attorney. How Much Does a Tax Attorney Cost.

DistributeResultsFast Is The Newest Place to Search. The first question that comes to the minds of those who are considering hiring a tax lawyer is how much its going to cost them. According to the National Association of Accountants the average cost for a tax professional to complete your taxes ranges from 176 to 27.

Free Case Review Begin Online. Ad Find Recommended Virginia Tax Accountants Fast Free on Bark. The average salary for a Tax Attorney is 100143.

Ad Legal Advice for any Area of Property Law Including Buying Selling Resolving Disputes. As an example of the different rates you can. The average cost for a Tax Attorney is 250.

Explore The Steps You Need To Take And Relief Options Available To You. Prices to suit all budgets. How much they charge per hour will be different depending on the lawyer and their years of experience.

Ad Find Relevant Results For How Much Does A Tax Attorney Cost. Heres a very simple breakdown of the average prices that tax attorneys charge for common tax services whether hourly or as a flat. See If You Qualify For IRS Fresh Start Program.

To hire a Tax Attorney to complete your project you are likely to spend between 150 and 450 total. April 21 2015 0 Comments in Tax Resources by SH. Be aware that hourly rates follow a wide range.

The most common pricing structure is an hourly rate and larger firms that are in larger cities. The complexity of your case can determine the rates. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Based on ContractsCounsels marketplace data the. Some tax attorneys charge a flat hourly rate with the large firms charging well in excess of 600 per hour. Salaries in the law field range from 58220 to 208000.

Experienced tax lawyers typically charge 200 to 400 an hour as of 2016 but their rates are subject to inflation just like everything else. Most personal injury lawyers handle cases on a contingency fee basis meaning the lawyer agrees to take a certain percentage of the final. 2 days agoJune 2 2022 446pm.

In fact a majority of individuals shy away from contacting. Injury or Accident Cases. Our study bore out that expectation with average minimum and maximum rates climbing from 235 and.

The following factors impact the cost. The cost of working with an IRS tax lawyer can be anywhere from 500 to 10000 and over. Everything You Need To Know.

What does it cost to hire a Tax Attorney. The average salary of a tax attorney is 120910 per year according to the BLS. Non-law firms are hiring attorneys to work on the case but if they close the attorney does not continue to work on the case.

Ad Based On Circumstances You May Already Qualify For Tax Relief. How Much Does a Tax Attorney Cost. Searching Smarter with Us.

Expect to put down a retainer based. The average case is about 5000. We Win Cases Free Evaluation Get Started.

How Much Does An IRS Tax Attorney Cost. Several factors may impact earning. In todays world most of us have run into the need for.

Some lawyers bill by the hour for their work while others quote a flat fee rate contingency rate or use retainer fees. For example most tax attorneys have a bill of 200 to 400 per hour. Ad Top-rated Accountants for any project.

Tax attorneys will almost always charge by the hour. You might also expect that lawyers charge higher rates as they gain more experience. Find Out How To Reduce Your Tax Liability.

How Much Does it Cost to Hire a Tax Attorney. Amber Heard cant pay the 104 million she owes Johnny Depp her lawyer revealed Thursday as sources told The Post the actress is broke. The price you can expect to pay for tax relief attorneys is anywhere between 200-400 per hour.

See If You Qualify For IRS Fresh Start Program. Ad Local Tax Planning Experts. Trial Cases Can Run 5000-15000.

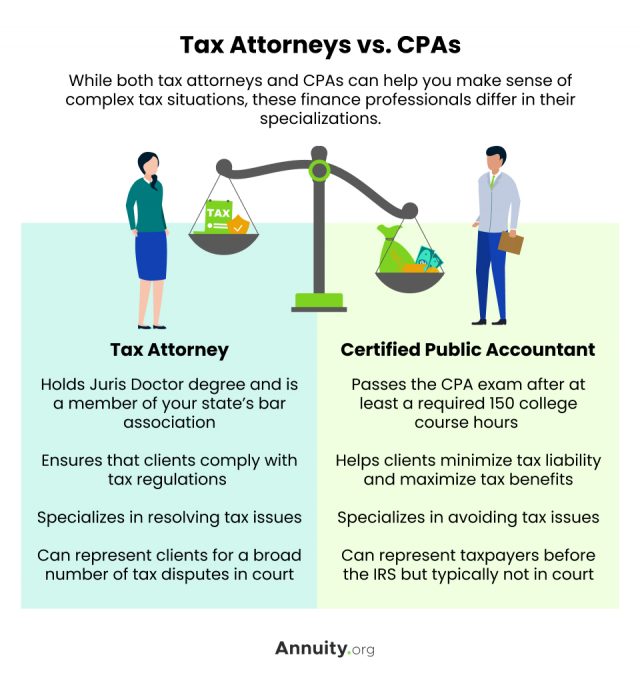

Cpa Vs Tax Attorney What S The Difference

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Tax Attorney Vs Cpa What S The Difference Turbotax Tax Tips Videos

7 Questions To Ask When You Re Vetting A Tax Lawyer Legalzoom Com

Tax Attorney When To Get One And What To Look For

Tax Attorney Charlotte Nc Solve Federal Tax Issues Cumberland Law Group Llc

2022 Average Cost Of Tax Attorney Fees Get Help Today Thervo

Credit Repair Laws Is Repair Legal In All 50 States Debt Com

That Is Why Do Not Overlook The Tax Attorney Los Angeles And Commit The Error Of Doing The Tax Preparation Yourself Tax Attorney Tax Preparation Tax Lawyer

Everything You Need To Know About A Tax Attorney Turbotax Tax Tips Videos

Rules For Renting Out A Vacation Home Many People Rent Out A Second Or Vacation Home To Help Offset The Cost Lease Agreement Free Rentals Accounting Services

Tax Attorney Vs Cpa Why Not Hire A Two In One Aaa Cpa

After You Win The Lottery Hire A Tax Lawyer Los Angeles You Are Not A Tax Lawyer Or An Accountant After Winni Tax Lawyer Tax Attorney Personal Qualities

How Much Does It Cost To Hire An Accountant To Do My Taxes Experian

How Much Does A Tax Attorney Cost Cross Law Group

How Much Does A Tax Attorney Cost Cross Law Group