student loan debt relief tax credit program for tax year 2021

The purpose of the Student Loan Debt Relief Tax Credit is to assist Maryland Tax Payers who have incurred a certain amount of undergraduate or graduate student loan debt by providing a tax credit on their Maryland State income tax return. Enter the total remaining balance on all undergraduate andor graduate student loan debt which is still due as of the submission of this application.

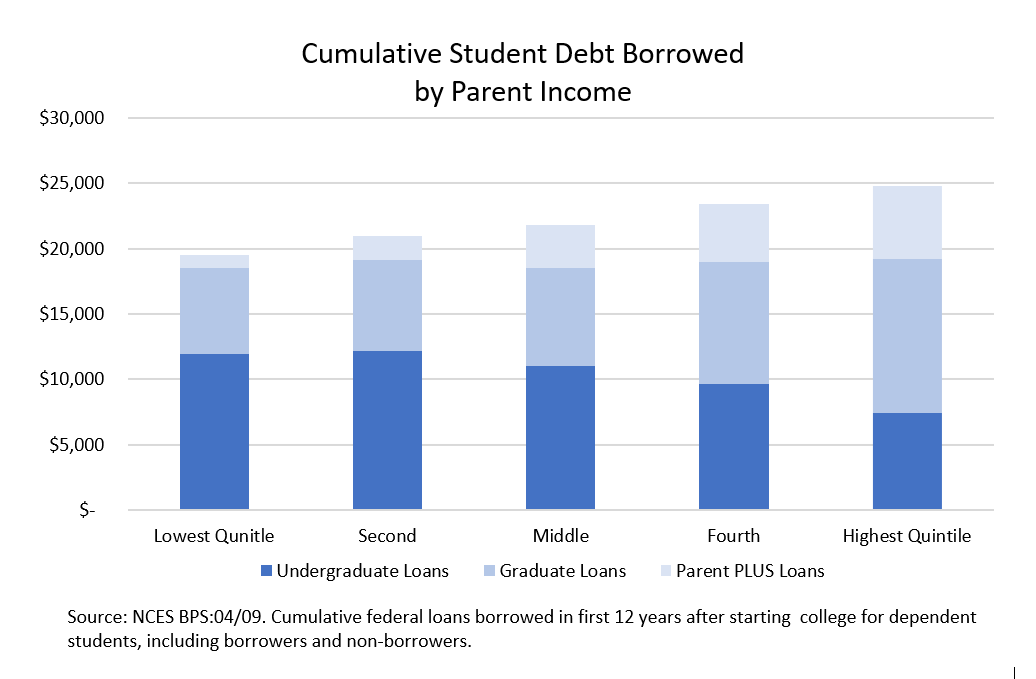

Student Loan Forgiveness Is Regressive Whether Measured By Income Education Or Wealth

The Student Debt Relief Program an.

. There were 9155 Maryland residents who were awarded the 2021 Student Loan Debt Relief Tax Credit. Backed by student loan giant Navient Earnest offers multiple loan repayment options and refinance loans for students and parents at competitive rates. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

8 hours agoThe Department of Education expanded the PSLF program in October 2021 to allow more loans to qualify. The Lifetime Learning Credit cannot be used in the same year for the same student if either the American Opportunity Tax Credit or the Tuition and Fees Deduction is claimed The credit is worth up to 20 of the first 10000 of qualified expenses and one deduction is allowed for each tax return so that if a parent has more than one student in. Under the new rules any prior payment made by a.

In October last year the Department of Education announced transformative changes to the Public Service Loan Forgiveness program. Corporate speak for a private student loan debt relief program. Practical Suggestion for Tax Refund.

A provision in the March 2021 COVID-19 relief package stipulates that any debt forgiven from Dec. Individuals paying back federal student loan debt can defer payments and interest through August 31 2022 approved April 6 2022. Our upcoming online seminars will tell you whats new and help you determine.

Enter the Maryland Adjusted Gross Income reported on your Maryland State Income Tax return form 502 line 16 for the most recent prior tax year. Those who attended in-state institutions received 1067 in tax credits while eligible applicants who attended. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt are eligible to apply for the Student Loan Debt Relief Tax Credit.

Complete the Student Loan Debt Relief Tax Credit application. Ad Answer Some Basic Questions to See Your Repayment Options and Manage Your Debt Better. 1 2026 will not count as income.

From July 1 2022 through September 15 2022. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans. Ad Connect with a Lender who can assist with Debt Support Urgent Expenses and More.

Close 866 612-9971 866 612-9971. Student Loan Debt Relief Tax Credit Program. CuraDebt is an organization that deals with debt relief in Hollywood Florida.

If this is contrary to the authors intent the bill should be amended to specify a phase-out amount. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Now through October 31 2022 you may be able to receive credit.

Suspended payments will appear as regularly rescheduled payments by credit-reporting agencies. 22 hours agoAs of 2022 the total private and federal student loans owed by Americans reached an excess of 17 trillion. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in.

AB 668 Petrie-Norris 20212022 would have under the PITL conformed to the student loan forgiveness provisions under the federal. See If You Qualify For Loan Forgiveness Under The Public Service Loan Forgiveness Program. Maryland taxpayers who maintain Maryland residency for the 2022 tax year.

The Public Service Loan Forgiveness Program promises tax-free student debt forgiveness to teachers nurses social workers and other full-time government and nonprofit employees. Top officials have been urging borrowers to apply for student loan forgiveness under the PSLF Waiver by the October 31 deadline. 31 2020 to Jan.

Means that the payments under the income-driven repayment plans will be lower than what you would have to pay on the 10-Year Standard Plan. Recent temporary changes to the federal Public Student Loan Forgiveness program may make you eligible for loan forgiveness even if you werent eligible before. In 2021 9155 Maryland residents received the Student Loan Debt Relief Tax Credit.

Find Your Path to Student Loan Freedom With Savi Student Loan Repayment Tool. Cardona settlement federal data show that total federal student loan forgiveness under all programs had reached 26 billion and 15 million borrowers. It was founded in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and is accredited with the International Association of Professional Debt Arbitrators.

Thus the majority of the residents have some form of. Maryland Adjusted Gross Income. Top Rated Lenders in your Area are here to Help.

But the changes are for a limited time only. This tax credit is given to help students offset some of their outstanding loan balances. Updated for filing 2021 tax returns.

The company also features a. About the Company Property Tax Relief Check. Ad Apply For Tax Forgiveness and get help through the process.

Is there relief for student loan debt during COVID-19. We are aware that student loan debt has become a growing concern among college graduates and wanted to remind you of a tax credit that you may be able to take advantage of. However an individual with 5000 in federal student loan debt would receive a refundable credit for the entire amount.

The Maryland Higher Education Commission MHEC is continuing their Student Loan Debt Relief Tax Credit for 2021. 73 billion in student loans discharged for public servants. Ad Try Our Free PSLF Tool To See Your Options and Eligibility For Student Loan Forgiveness.

Ad Tax Credit Studies That Are Sustainable And Seriously Simple. Pay off Credit Card Debt. 31 2022 you can get credit for the payments you made on Federal Family.

Exclusive member benefit brought to you by the UFT is here to help. Advise Your Clients With An RD Tax Credit Partner You Trust. Student loan forgiveness in 2021 will not increase your taxable income thanks to the latest American Rescue Plan that makes all student loan forgiveness tax-free.

2 days agoEven before the Sweet v. To be considered for the tax credit applicants must complete the. To qualify you normally have to make 120 qualifying payments on Direct Loans.

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Are You Eligible For Sallie Mae Student Loans In 2022 Sallie Mae Student Loans Teacher Loan Forgiveness Student Loan Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Current Student Loans News For The Week Of Feb 14 2022 Bankrate

Student Loan Forgiveness May Come With Tax Bomb Here S What You Should Know

Filing Taxes With Student Loans Top Tax Breaks That Can Help You Get A Larger Refund Cnet

Protect Yourself And Your Device Taxes Security In 2021 Tax Refund Saving For College Tax Debt

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Student Loan Forgiveness Changes Who Qualifies And How To Apply Under Biden S Expansion Of Relief

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Student Loan Forgiveness Statistics 2022 Pslf Data

Biden Plan Would Eliminate Student Loan Forgiveness Tax Bomb

10 Grants To Pay Off Your Student Loans Faster Student Loan Planner Student Loans Paying Off Student Loans International Student Loans

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Taxes On Forgiven Student Loans What To Know Student Loan Hero

Student Loan Relief Could Happen With These 3 Bills In Congress